🚀 BaseSwap Exchange: Unlocking the Future of DeFi Trading

In the ever-evolving landscape of decentralized finance (DeFi), BaseSwap Exchange has emerged as a groundbreaking platform that reshapes how traders, liquidity providers, and crypto enthusiasts interact with blockchain assets. 🌐 As we navigate deeper into the age of Web3, understanding innovative exchanges like BaseSwap is crucial for anyone aiming to stay ahead of the curve.

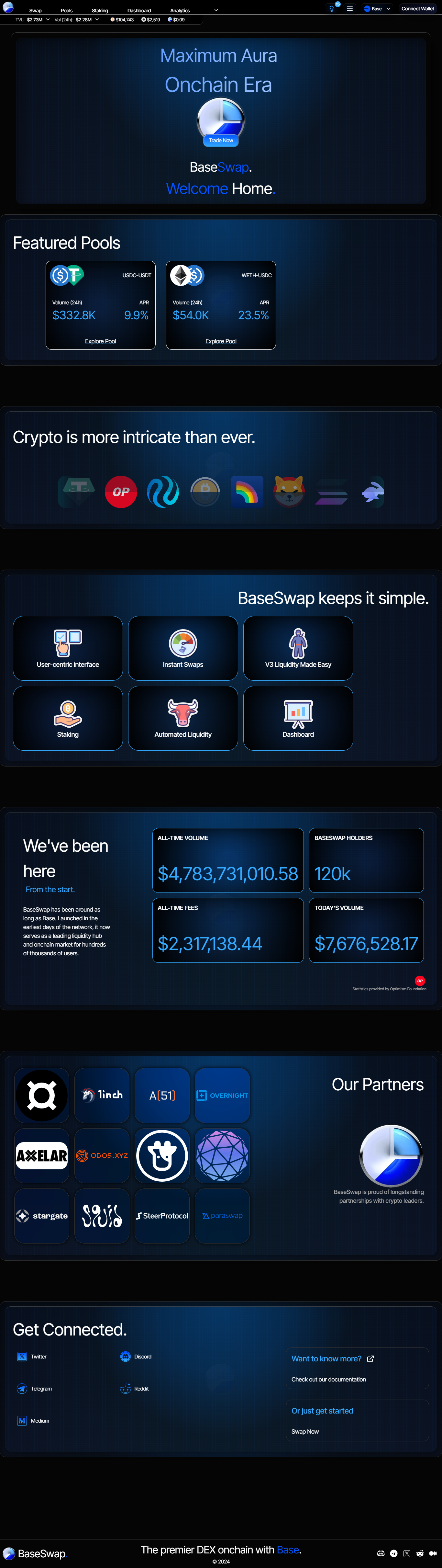

🌟 What is BaseSwap Exchange?

BaseSwap Exchange is a decentralized exchange (DEX) built on top of modern blockchain protocols, offering seamless token swaps, liquidity pooling, and yield farming—all without the intervention of centralized intermediaries. Unlike traditional exchanges, where you must entrust your funds to a third party, BaseSwap empowers users to retain full control over their assets through smart contracts and self-custodial wallets. 🔐

The platform is meticulously designed to facilitate:

✅ Instant token swaps: Users can exchange tokens directly from their wallets with minimal slippage. ✅ Liquidity pools: Anyone can become a liquidity provider and earn transaction fees and rewards. ✅ Staking & farming: Users can stake liquidity tokens to farm additional rewards, bolstering passive income streams.

🧬 Cutting-Edge Technology & Algorithms

BaseSwap stands out due to its use of advanced automated market maker (AMM) algorithms. These algorithms dynamically adjust prices based on real-time supply and demand within liquidity pools, ensuring that trades remain fair and efficient even during volatile market conditions. 📊

Moreover, the protocol often integrates mechanisms such as dynamic fee adjustments, which can optimize for either higher liquidity or lower trading fees depending on market activity. This intelligent approach significantly mitigates impermanent loss—a common concern for liquidity providers.

💸 Security and Transparency: Trust in Code

In the DeFi ecosystem, security is paramount. BaseSwap’s smart contracts are typically audited by reputable third-party security firms, ensuring that vulnerabilities are identified and patched. 🛡️ Additionally, since all transactions are recorded on-chain, users can independently verify activities, fostering unparalleled transparency.

Key security features include:

- Permissionless access: No central authority to freeze or seize funds.

- Immutable contracts: Once deployed, smart contracts run as programmed without interference.

- Decentralized governance: Often, BaseSwap will involve community voting for protocol upgrades, putting power back into users’ hands.

🌱 Incentives for Users & Liquidity Providers

Liquidity is the lifeblood of any exchange. To incentivize participation, BaseSwap frequently offers:

🎁 Liquidity mining rewards: Extra tokens for providing liquidity. 🔥 Reduced trading fees: Especially for native token holders. 💎 Governance privileges: Users can vote on proposals, such as new token listings or protocol upgrades.

These initiatives not only attract liquidity but also cultivate a vibrant, engaged community.

🚀 Future Prospects and Innovations

What truly sets BaseSwap apart is its commitment to innovation. The roadmap for many of these platforms includes integrating layer-2 scaling solutions (like Optimistic Rollups or zkRollups), which drastically reduce gas fees and enhance transaction speeds. ⚡

Furthermore, many versions of BaseSwap plan to support cross-chain swaps, breaking down silos between different blockchains and enabling seamless interoperability. Imagine swapping an Ethereum-based token for a Solana token directly—without ever going through a centralized bridge! 🌉

🧭 Final Thoughts

As DeFi continues to revolutionize the financial world, platforms like BaseSwap Exchange are at the forefront of this decentralized renaissance. With its blend of sophisticated algorithms, robust security measures, and enticing user incentives, BaseSwap is not merely an exchange—it’s a gateway to the future of digital finance. 🚀

Whether you’re a seasoned DeFi strategist or a newcomer eager to explore decentralized markets, BaseSwap offers a compelling, secure, and user-centric environment to thrive in. So, why not take the plunge? Your next trading frontier awaits. 🌊

Made in Typedream